AUD/USD Forecast: Key Technical Levels and Market Influences

The AUD/USD outlook appears increasingly positive from both macroeconomic and technical perspectives. Recent developments, such as the rise in copper prices, continued optimism about China’s economic recovery, and the Reserve Bank of Australia’s (RBA) renewed tightening bias (despite the likelihood of no further rate hikes this year), have all contributed to supporting the Aussie dollar. In contrast, the US has seen softer economic data, reigniting discussions about potential rate cuts, though inflation concerns persist as we await the US CPI data release on Wednesday. A critical focus is on whether the AUD/USD can break above the 0.6650 level, which would reinforce our short-term bullish stance.

Technical Analysis and Key Levels

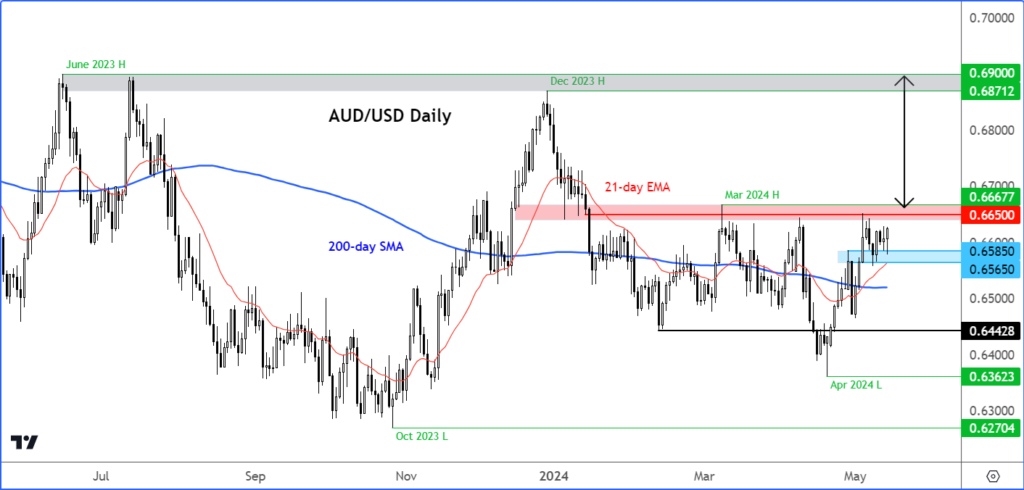

From a technical standpoint, the AUD/USD is showing constructive signals. Although it hasn’t yet broken out, it appears poised to establish a higher high, potentially surpassing the March 2024 peak of 0.6667.

Resistance: The significant resistance zone to monitor is between 0.6650 and 0.6667. This range has proven challenging for the pair to breach in recent months, as evidenced by multiple failed attempts. However, recent bullish price action suggests a breakout might be imminent.

Support: The AUD/USD has managed to maintain support within the 0.6565 to 0.6585 range, which previously served as resistance. This support level has also held above the 21-day exponential moving average, indicating underlying strength.

Market Dynamics: Following the recent Producer Price Index (PPI) data from the US, the AUD/USD saw an uptick as traders anticipated the upcoming CPI report. Despite a stronger-than-expected PPI print, the market largely discounted it due to downward revisions in prior data and muted core inflation metrics. This has set the stage for a potential breakout in the Asian session if the CPI report does not reignite inflationary concerns.

Potential Scenarios

If the AUD/USD successfully breaches the 0.6650 to 0.6667 resistance zone, it could initially target the 0.6750 level, with further gains potentially reaching the December high around 0.6870. However, a decisive break above the 0.6650 to 0.6667 range is necessary for confirmation of a bullish trend.

US Dollar Dynamics Post-PPI

On Tuesday, the AUD/USD strengthened ahead of the US CPI release. The PPI data indicated a 0.5% increase month-over-month for both headline and core metrics, driven mainly by services. However, downward revisions in previous months and a decline in some core PPI components lessened the immediate impact on the markets.

CPI Expectations: Analysts forecast a moderation in the CPI for April, with a projected annual rate of 3.4%, down from 3.5% in March. The month-over-month increase is expected to be 0.4%, with Core CPI rising 0.3% m/m and 3.6% y/y. This anticipated moderation may offer insights into potential Fed adjustments to interest rates.

Federal Reserve Outlook: Jerome Powell has suggested that despite limited inflation progress in the first quarter, he expects a gradual decline in prices moving forward.

In conclusion, traders are closely watching the upcoming CPI report for a clearer indication of future Fed actions. A breakout above the key technical levels for AUD/USD would support the short-term bullish view, while the CPI data will be critical in shaping market expectations.